In an era marked by extreme weather, climate volatility, and increasing insurance gaps, parametric insurance has emerged as a powerful tool for delivering fast, transparent payouts. As natural disasters intensify across the globe, especially in the USA and Europe, traditional indemnity models often fall short in providing timely support. Enter parametric insurance—a data-driven, trigger-based solution revolutionizing how we approach risk.

What Is Parametric Insurance?

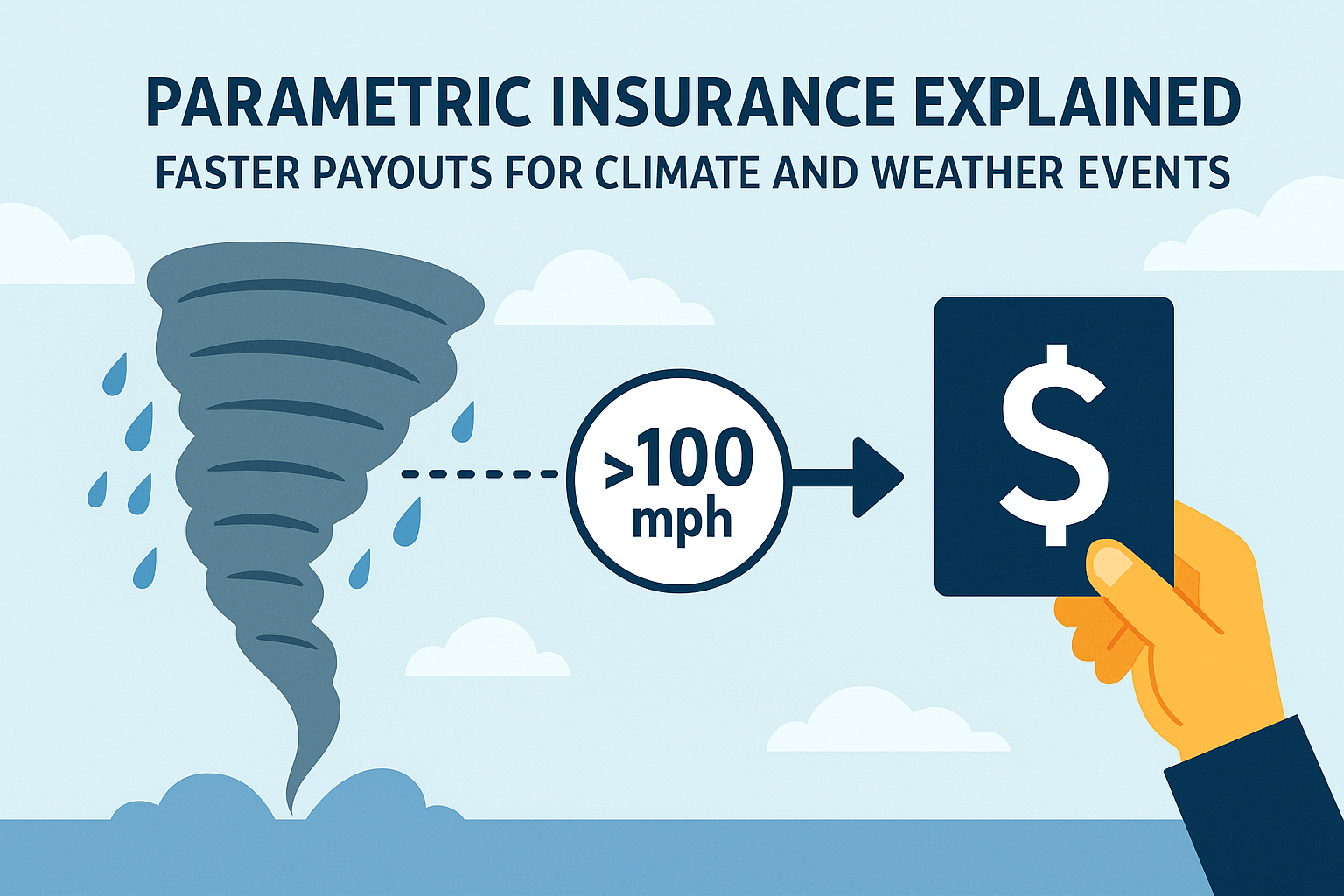

Parametric insurance is a type of coverage that pays out based on predefined parameters, not actual financial loss. Instead of adjusting claims after an event, it uses objective data points—like wind speed, rainfall amount, or earthquake magnitude—as the basis for payout.

For example:

-

If wind speeds exceed 120 mph during a storm, the policyholder receives a payout—regardless of the actual damage.

-

If rainfall falls below a certain threshold during a farming season, a drought coverage policy pays automatically.

This model provides a clear, fast, and efficient process compared to traditional claims adjustment methods.

Why Is It Trending in 2025?

Several factors are driving a global surge in interest and adoption of parametric insurance:

1. Faster Payouts

Payouts are issued within days—or even hours—after a trigger is met, offering immediate liquidity for recovery.

2. Clarity and Transparency

Policy terms are simple: if X happens, you get Y. This eliminates complex post-event negotiations or assessments.

3. Climate Resilience

With climate-related disasters becoming more frequent in both North America and Europe, parametric coverage enables quick funding for recovery, helping vulnerable regions bounce back faster.

4. Digital Enablement

Technologies like IoT sensors, satellite data, and blockchain have made trigger tracking and automation reliable and secure.

Real-World Applications

-

Caribbean governments use parametric hurricane coverage to access immediate disaster funds.

-

Farmers rely on rainfall or drought-indexed crop insurance to protect yields.

-

SMEs and microbusinesses in Europe use wind-speed based protection to cover business interruption.

-

Innovative income protection schemes now use parametric triggers to support gig workers or individuals affected by AI-driven job displacement.

Market Growth and Future Outlook

The parametric insurance market is expected to grow from $17 billion in 2024 to over $40 billion by 2033. North America leads adoption, followed by Europe—especially in agriculture, climate risk management, and small business resilience sectors.

Insurers are increasingly bundling parametric cover with traditional indemnity policies, providing comprehensive and fast coverage in tandem.

Challenges and Considerations

While parametric insurance offers many benefits, it is not without limitations:

-

Basis Risk: There is a chance the trigger is met, but actual damage is minimal—or vice versa. This misalignment is called basis risk.

-

Trigger Calibration: Accurate, meaningful trigger points are essential. Setting them too high or low affects reliability.

-

Supplementary Role: Parametric policies usually complement, not replace, traditional coverage.

Who Should Consider Parametric Insurance?

-

Risk Managers & CFOs: Looking to improve liquidity and resilience planning.

-

NGOs & Government Agencies: Seeking fast relief tools in disaster-prone zones.

-

Farmers & SMEs: Needing protection against weather volatility and business interruption.

-

Insurers & Brokers: Wanting to diversify offerings with innovative, data-driven solutions.

Conclusion

Parametric insurance is not just a trend—it’s a strategic response to the evolving nature of risk in a climate-stressed and fast-paced world. With growing availability, improved data access, and rising demand for speed, transparency, and simplicity, this model is set to reshape how individuals, governments, and businesses manage unpredictable loss events.

Whether you’re a business owner, policyholder, or insurance provider, understanding parametric coverage today can help build financial resilience for tomorrow.