Introduction

Insurance has always been a data-driven industry, relying on vast amounts of information to assess risk, set premiums, and process claims. In recent years, the advent of artificial intelligence (AI) and machine learning (ML) has revolutionized the insurance sector, giving rise to a new wave of technological advancements known as insurtech. This blog post explores the various ways in which AI and ML are being used in the insurance industry, highlighting the benefits and challenges of these innovations.

The Role of AI in Insurance

AI refers to the simulation of human intelligence in machines that are programmed to think and learn like humans. In the insurance industry, AI is being used to automate and streamline various processes, improving efficiency and accuracy. One of the key applications of AI in insurance is in underwriting, the process of assessing risk and determining premiums. AI algorithms can analyze large volumes of data, such as customer information, claims history, and external factors, to make more accurate predictions about risk and pricing.

Another area where AI is making significant contributions is in claims processing. By using natural language processing (NLP) and image recognition technologies, AI can analyze claim documents and images to determine their validity and expedite the claims settlement process. This not only reduces the time and effort required for manual claims processing but also helps detect fraudulent claims more effectively.

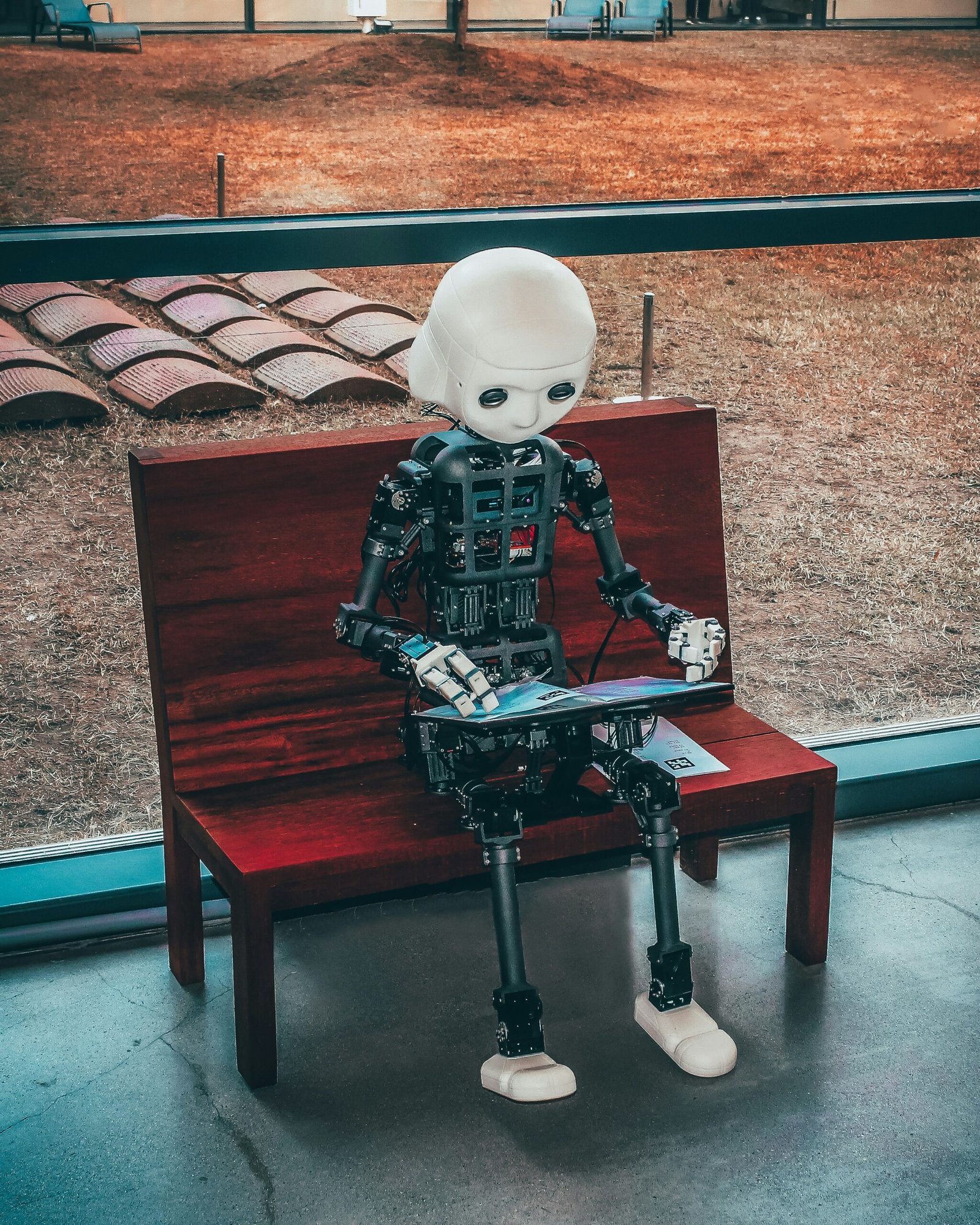

AI-powered chatbots are also becoming increasingly common in the insurance industry. These virtual assistants can handle customer queries, provide information about policies, and even help customers file claims. By leveraging AI, insurance companies can provide round-the-clock support, improve customer experience, and reduce the workload on their customer service teams.

The Power of Machine Learning in Insurance

Machine learning, a subset of AI, focuses on the development of algorithms that can learn from and make predictions or decisions based on data. In the insurance industry, machine learning is being used to enhance risk assessment, fraud detection, and customer engagement.

One of the primary applications of machine learning in insurance is in risk assessment. By analyzing historical data and patterns, machine learning algorithms can identify correlations and make predictions about future events. This enables insurance companies to more accurately assess risk and set appropriate premiums. For example, in auto insurance, machine learning algorithms can analyze driver behavior data collected from telematics devices to determine the likelihood of accidents and adjust premiums accordingly.

Machine learning is also being used to combat insurance fraud. By analyzing large datasets and detecting patterns of fraudulent behavior, machine learning algorithms can help identify suspicious claims and flag them for further investigation. This not only saves insurance companies from financial losses but also helps in maintaining the integrity of the insurance system.

Customer engagement is another area where machine learning is proving to be invaluable. By analyzing customer data and behavior, machine learning algorithms can personalize the insurance experience, offering tailored recommendations and suggestions. This not only helps in improving customer satisfaction but also enables insurance companies to cross-sell or upsell their products more effectively.

Challenges and Considerations

While AI and machine learning offer immense potential for the insurance industry, there are several challenges and considerations that need to be addressed.

Data quality and privacy are among the primary concerns when it comes to implementing AI and machine learning in insurance. To train accurate and reliable models, insurance companies need access to high-quality data. However, data in the insurance industry is often fragmented, incomplete, or inconsistent. Additionally, there are strict regulations governing the use and protection of customer data, which must be adhered to.

Another challenge is the interpretability of AI and machine learning models. Insurance decisions have significant implications for individuals and businesses, and it is crucial to understand how these decisions are being made. Explainable AI (XAI) is an emerging field that aims to make AI and machine learning models more transparent and interpretable. This is particularly important in the insurance industry, where decisions regarding risk assessment and claims processing can have far-reaching consequences.

Furthermore, the adoption of AI and machine learning in insurance requires a shift in organizational culture and mindset. Insurance companies need to invest in the necessary infrastructure, talent, and resources to implement and maintain these technologies. Additionally, employees need to be trained to work alongside AI systems and understand their limitations.

The Future of AI and Machine Learning in Insurance

The use of AI and machine learning in the insurance industry is still in its early stages, but the potential for growth and innovation is immense. As technology continues to evolve, we can expect to see further advancements in areas such as risk assessment, fraud detection, and customer experience.

One area that holds great promise is the use of AI and machine learning in predictive analytics. By analyzing vast amounts of data, including social media posts, weather patterns, and economic indicators, insurance companies can gain insights into emerging risks and develop proactive strategies to mitigate them. This can help in reducing losses and improving overall risk management.

Another area of interest is the use of AI in claims settlement. By leveraging technologies such as computer vision and natural language processing, AI can automate the claims assessment process, reducing the need for manual intervention. This not only speeds up the claims settlement process but also improves accuracy and reduces the potential for human error.

Furthermore, the integration of AI and machine learning with other emerging technologies, such as the Internet of Things (IoT) and blockchain, can unlock new possibilities in the insurance industry. For example, IoT devices can provide real-time data on insured assets, enabling insurance companies to offer usage-based policies and adjust premiums accordingly. Similarly, blockchain technology can enhance data security and streamline the claims settlement process by providing a transparent and immutable record of transactions.

Conclusion

AI and machine learning are transforming the insurance industry, enabling companies to automate processes, improve risk assessment, detect fraud, and enhance customer engagement. While there are challenges and considerations to overcome, the potential for innovation and growth is immense. As technology continues to advance, we can expect AI and machine learning to play an increasingly vital role in shaping the future of insurance.