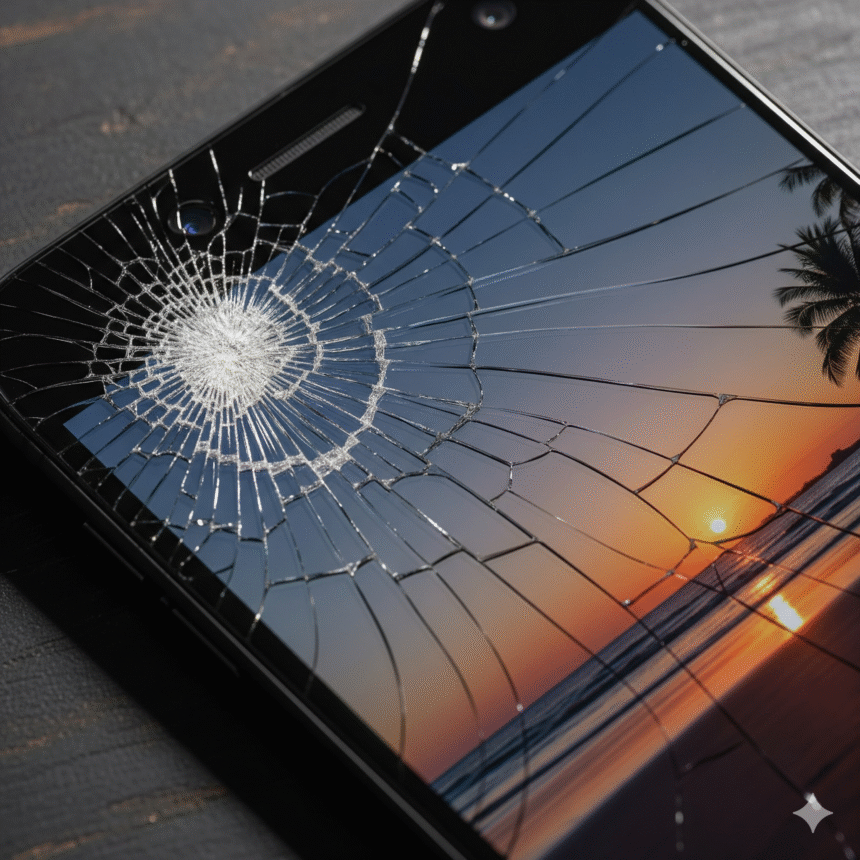

The release of a new iPhone is always a highly anticipated event, and the iPhone 17 Pro is no exception. With its cutting-edge A19 Pro chip, advanced camera system, and stunning Super Retina XDR display, the iPhone 17 Pro represents a significant investment. While the device is built with enhanced durability features like the Ceramic Shield 2, life is unpredictable, and accidents happen. From a sudden drop on the pavement to a splash of water, a single mishap can turn your high-end smartphone into a costly repair bill. This is where smartphone insurance comes into play, offering a critical layer of financial protection and peace of mind.

Insuring your new iPhone 17 Pro isn’t about being overly cautious; it’s about being prepared. The reality of modern smartphones is that their complexity and premium materials make out-of-warranty repairs incredibly expensive. By understanding the options available—from Apple’s own AppleCare+ to various third-party providers—you can make an informed decision that safeguards your investment against the unexpected.

The High Cost of DIY and Out-of-Warranty Repairs

Before diving into the world of insurance, it’s essential to grasp the potential cost of repairing your iPhone 17 Pro without a protection plan. Apple’s out-of-warranty repair fees can be staggering. For instance, a cracked screen repair on the iPhone 17 Pro can cost hundreds of dollars, while “other damage” repairs, which cover issues like extensive liquid damage or multiple component failures, can easily run into the thousands. Even a battery replacement, which might seem like a minor issue, comes with a significant price tag.

These costs highlight the value proposition of insurance. Without coverage, you are essentially self-insuring your device, and the financial risk is entirely on you. A single accident could mean you are on the hook for a repair bill that is a substantial percentage of the phone’s original purchase price, or even more. This financial strain can be particularly difficult for those who have just spent a large sum on their new device. The psychological burden of constantly worrying about potential damage can also detract from the enjoyment of using your advanced new phone.

A Deep Dive into AppleCare+

For many iPhone owners, the first and most obvious choice for insurance is AppleCare+. This plan is the gold standard for Apple users, offering a seamless and integrated experience. AppleCare+ extends your iPhone 17 Pro’s standard one-year limited warranty and provides comprehensive coverage for accidental damage. With an AppleCare+ plan, you are covered for an unlimited number of incidents, which can be a huge relief for accident-prone individuals.

For many iPhone owners, the first and most obvious choice for insurance is AppleCare+. This plan is the gold standard for Apple users, offering a seamless and integrated experience. AppleCare+ extends your iPhone 17 Pro’s standard one-year limited warranty and provides comprehensive coverage for accidental damage. With an AppleCare+ plan, you are covered for an unlimited number of incidents, which can be a huge relief for accident-prone individuals.

The key benefits of AppleCare+ include low service fees for repairs. A cracked screen, for example, can be fixed for a small flat fee, a fraction of the out-of-warranty cost. Other damage is also covered for a low service fee. This makes repairs predictable and manageable. Furthermore, AppleCare+ provides priority access to Apple’s technical support and certified repairs using genuine Apple parts. This ensures that your device is handled by experts who know it best.

AppleCare+ plans also have a “Theft and Loss” option, which is an invaluable addition. While the standard plan covers damage, it doesn’t protect against losing your phone or having it stolen. The Theft and Loss plan provides a replacement device for a higher deductible, saving you from having to purchase a new phone entirely out of pocket if the worst happens. The peace of mind that comes with knowing your device is protected from loss or theft is priceless, especially given the high value of the iPhone 17 Pro.

Exploring Third-Party Insurance Providers

While AppleCare+ is an excellent choice, it’s not the only one. The market is filled with a variety of third-party insurance providers that offer compelling alternatives. Companies like Verizon, AT&T, and other independent insurers provide their own protection plans that can sometimes be more flexible or affordable depending on your needs.

One of the main advantages of third-party insurance is the potential for customized policies. You might find a plan that offers a lower monthly premium or a different deductible structure that better fits your budget. Some providers even offer multi-gadget plans, allowing you to bundle your iPhone 17 Pro with other electronics, such as a laptop or an Apple Watch, under a single policy. This can be a cost-effective solution for households with multiple valuable devices.

However, there are a few considerations when opting for a third-party plan. The repair process might not be as straightforward as with AppleCare+. You may have to deal with third-party repair centers instead of an official Apple Store, and there is a possibility that they may not use genuine Apple parts. It is crucial to read the fine print of any insurance policy to understand its coverage limitations, deductibles, and the claims process. You should look for policies that offer worldwide coverage and have a clear, easy-to-use claims portal.

The Verdict: Is Insurance Worth the Cost?

Ultimately, the decision to insure your iPhone 17 Pro is a personal one, but when you weigh the potential costs, the answer becomes clear for most people. The initial cost of a premium iPhone is significant, and the repair costs in the event of an accident are equally substantial. For a few dollars a month, you are transferring that risk from your own bank account to an insurance provider.

Ultimately, the decision to insure your iPhone 17 Pro is a personal one, but when you weigh the potential costs, the answer becomes clear for most people. The initial cost of a premium iPhone is significant, and the repair costs in the event of an accident are equally substantial. For a few dollars a month, you are transferring that risk from your own bank account to an insurance provider.

Consider this: the emotional and financial stress of a shattered screen or a water-damaged device can be immense. With insurance, that stress is replaced with a clear, defined process and a manageable fee. Whether you choose the comprehensive, hassle-free experience of AppleCare+ or the potentially more flexible options of a third-party insurer, the core benefit remains the same: protecting your investment.

In a world where our smartphones are not just communication tools but our cameras, wallets, and connection to everything, their value extends far beyond their monetary price. Insuring your iPhone 17 Pro is not just a smart financial decision; it’s a way of protecting a device that is central to your daily life. It’s an investment in your peace of mind, ensuring that when life inevitably happens, your new device is well-protected.